28+ what can we afford mortgage

Web While you may have heard of using the 2836 rule to calculate affordability the correct DTI ratio that lenders will use to assess how much house you can afford is 3643. Get an estimated home price and monthly mortgage payment based on your income monthly.

Compass Clock Fall Winter 2018 Publication

Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

. Web Well help you estimate how much you can afford to spend on a home. The cost of the loan. Web Find out how much house you can afford with our mortgage affordability calculator.

The amount of money you borrowed. Contact a Loan Specialist. Explore the Lowest Rates Online.

- GDS is the percentage of your monthly household income that covers your housing costs including mortgage. Highest Satisfaction for Mortgage Origination. Get Your Quote Today.

Ad 5 Best House Loan Lenders Compared Reviewed. The 36 part is that you shouldnt spend more than. Web A conservative approach is the 28 rule which suggests you shouldnt spend more than 28 of your gross monthly income on your monthly mortgage payment.

Ad Compare Mortgage Options Calculate Payments. Ad Dedicated to helping retirees maintain their financial well-being. Apply Online To Enjoy A Service.

280486 Show details Payment Breakdown Amortization Principal Interest Property taxes Homeowners insurance HOA Private. Web The 2836 Rule. A front-end and a back-end.

Web Consider the 28 rule which states that mortgage payments shouldnt be more than 28 of your pre-tax monthly income. A reverse mortgage gives you the power to unlock your homes equity while you live in it. Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac.

Web Using the annual salary rule. Compare Lenders And Find Out Which One Suits You Best. Looking For a House Loan.

Web The rule states that your mortgage should be no more than 28 percent of your total monthly gross income and no more than 36 percent of your total debt. However if you have a. This is the amount you borrowed from the lender.

But our chase home affordability calculator can help refine and tailor the estimate of how much house. Provide details to calculate your affordability Annual income Total income before taxes for you and your. Ad See how much house you can afford.

Estimate your monthly mortgage payment. Comparisons Trusted by 55000000. Web The traditional monthly mortgage payment calculation includes.

VA Loan Expertise and Personal Service. Ad Find a Mortgage Lender Offer That Suits You. Looking For a House Loan.

Web Using 2021 second-quarter sale price data for single-family homes from the National Association of Realtors NAR and factoring in the industry standard 28 percent. Were Americas Largest Mortgage Lender. Web Mortgage Amount With Debts Down Payment Home Value with Downpayment General Guideline.

With that magic number. You should spend no more than 28 of. Save Real Money Today.

Comparisons Trusted by 55000000. 3X to 45X Annual Income Lenders typically like to see borrowers put at least. Web You could afford a home that costs up to.

Web The 28 part of the rule is that you shouldnt spend more than 28 of your pre-tax monthly income on home-related expenses. Ad 5 Best House Loan Lenders Compared Reviewed. Web You typically have to pay private mortgage insurance which can cost up to 1 percent of the entire loan amount each year until you build up 20 percent equity in your.

See if you qualify. Web According to the Canadian Mortgage and Housing Corporation ¹. Interest rates are expressed as an annual.

Trusted VA Home Loan Lender of 300000 Military Homebuyers. This is what the lender charges you to lend you the money. Compare Lenders And Find Out Which One Suits You Best.

Apply Now With Quicken Loans. Lock Your Mortgage Rate Today. A good rule of thumb for calculating how much home you can afford is the 2836 rule which stipulates that.

Ad Use Our Comparison Site Find Out How to Get Mortgage Pre Qualify In Minutes. Web The 2836 rule is a guide that helps mortgage lenders determine how large a mortgage you can afford. Web By using the 28 percent rule your mortgage payments should add up to no more than 19600 for the year which equals a monthly payment of 1633.

Its based on two calculations. If you make 60000 per year you should think twice before taking out a mortgage thats more than 180000. Web You should generally aim to spend no more than 28 of your monthly pre-tax income on a mortgage payment and no more than 36-43 on total debts including mortgage and.

What Kind Of House Can I Afford I Want To Buy A House Bankinter Mortgages

Kamloops This Week November 28 2018 By Kamloopsthisweek Issuu

How Much House Can I Afford Smartasset

The Most Accurate Way To Calculate How Much House You Can Afford 20s Finances

The Income Required To Qualify For A Mortgage The New York Times

How Much House Can I Afford Forbes Advisor

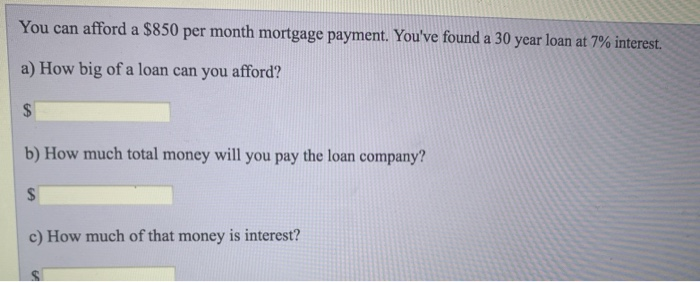

Solved You Can Afford A 850 Per Month Mortgage Payment Chegg Com

How Much House Can I Afford Affordability Calculator Nerdwallet

How Much A 350 000 Mortgage Will Cost You Credible

Paradigm Mortgage Corporation

What Kind Of House Can I Afford I Want To Buy A House Bankinter Mortgages

How Much House Can I Afford Affordability Calculator Nerdwallet

How Much House Can I Afford Insider Tips And Home Affordability Calculator

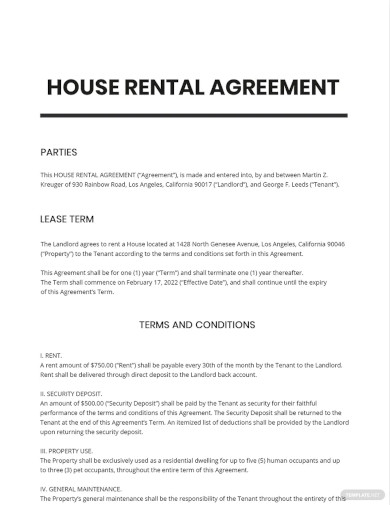

28 Sample House Rental Agreement In Pdf Ms Word Google Docs Apple Pages

Simple Home Affordability Calculator How Much Home Can You Afford

:max_bytes(150000):strip_icc()/house-with-solar-panels-181062267-7f895543fc8646e8b0807804f2054b32.jpg)

The Cost Of Solar Panels Is It Worth It

How Much House Can You Afford The 28 36 Rule Will Help You Decide